What is Working Capital Formula and Ratio

Content

For example, a company may decide to exclude the compensating balance of its bank accounts from the total amount of cash. Compensating balance represents the amount of money a bank requires an account holder to leave in its bank account at all times. Other exclusions many include the non-current portion of inventory and cash temporarily placed in marketable securities for business expansions. Within the current ratio formula, current assets refers to everything that your company possesses that could be liquidated, https://www.bookstime.com/ or turned into cash, within one year. As opposed to long-term assets like property or equipment, current assets include things like accounts receivable and inventory—along with all the cash your business already has. The current ratio, also known as the working capital ratio, is a measure of a company’s liquidity, or its ability to meet short-term obligations. By comparing current assets to current liabilities, the ratio shows the likelihood that a business will be able to pay rent or make payroll, for example.

Also, it does not compare the timing of when current assets are to be liquidated to the timing of when current liabilities must be paid off. Thus, a positive net working capital ratio could be generated in a situation where there is not sufficient immediate liquidity in current assets to pay off the immediate requirements of current liabilities. Managing working capital with accounting software is important for your company’s health. Positive working capital means you have enough liquid assets to invest in growth while meeting short-term obligations, like paying suppliers and making interest payments on loans. Negative working capital, on the other hand, means that the business doesn’t have enough liquid assets to meet it current or short-term obligations.

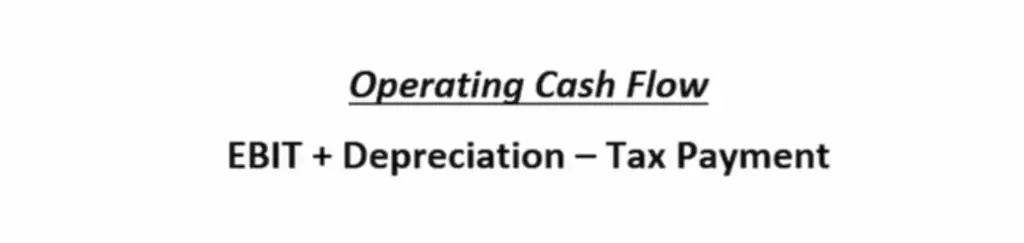

Cash Flow Statement Template

The assumption made by many owners is that earnings will pay for the permanent increase in working capital. Notice in the example above, it takes two years of earnings to create enough cash to cover the increase in working capital.

- Working capital is one of the most essential measures of a company’s success.

- In order to avoid this, analysts incorporate a debt maturity schedule that allows them to identify upcoming due dates for a business’ long term debt that may radically change the Working Capital Ratio.

- They are categorized as current assets on the balance sheet as the payments expected within a year.

- The current ratio is the proportion, quotient, or relationship between the amount of a company’s current assets and the amount of its current liabilities.

- If the ratio is 1, it shows that the current assets equal current liabilities, and it’s considered middle ground.

You can narrow the focus of your Net working capital calculation by removing cash and debts. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. Notes receivable — such as short-term loans to customers or suppliers — maturing within one year. Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends.

Working Capital Presentation on Cash Flow Statement

You can find both of these current accounts stated separately from their long-term accounts on the balance sheet. working capital ratio formula This presentation is helpful to creditors and investors, as it allows them to get more data to analyze the firm.

- Negative working capital is never a sign that a company is doing well, but it also doesn’t mean that the company is failing either.

- The calculation of the net working capital ratio would indicate a positive balance of $300,000.

- The current ratio is a liquidity ratio often used to gauge short-term financial well-being; it’s also known as the working capital ratio.

- These assets include cash, customers’ unpaid bills, finished goods, and raw materials.

- Working capital management focuses on ensuring the company can meet day-to-day operating expenses while using its financial resources in the most productive and efficient way.

- The quick ratio is $110,000 divided by $100,000, coming out to 1.1.

- If you’d like more detail on how to calculate working capital in a financial model, please see our additional resources below.

Assets are defined as property that the business owns, which can be reasonably transformed into cash (equipment, accounts receivables, intellectual property, etc.). When taking on new clients, don’t forget to conduct customer credit checks. You want to be sure the new business will increase your revenues and safeguard your working capital. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

Definition of the working capital ratio formula

Notes PayableNotes Payable is a promissory note that records the borrower’s written promise to the lender for paying up a certain amount, with interest, by a specified date. Current liabilities are such they will be due within a year or will have to be paid within one year. Especially if you check the working capital situation of Sears Holdings and calculate the working capital ratio, you will note that this ratio has been decreasing continuously for the past ten years or so. Sears Holding stock fell by 9.8% due to continuing losses and poor quarterly results. Sears’s balance doesn’t look too good, either.Moneymorning has named Sears Holding one of the five companies that may go bankrupt soon. However, these ratios generally differ with the industry type and will not always make sense.

By providing a monetary indicator of supply and demand, this formula can help you adequately plan for an increase in sales, without running out of the cash needed to obtain the products or materials to satisfy growth. Other current liabilities vary depending on your occupation, your industry, or government regulations. In addition to business licenses and permits, some practitioners require annual licensing or continuing education. For example, individual architects in all 50 states require licenses with regular renewals. So do many engineering, construction, financial services, insurance, healthcare, dental, and real estate professionals.

A high Working Capital Turnover ratio is a significant competitive advantage for a company in any industry. Negative working capital is a giant red flag for a company as it means that the company is in financial trouble and management needs to act immediately to source additional funding. Yes, a companies working capital ratio can be negative if a companies Working Capital is negative. The ratio is very useful in understanding the health of a company. Expert advice and resources for today’s accounting professionals.

How can we save working capital?

- 1) Keep your net working capital ratio in check.

- 2) Improve your inventory management.

- 3) Manage expenses better to improve cash flow.

- 4) Automate processes for your business financing.

- 5) Incentivize receivables.

- 6) Establish penalty for late payments.

Providing centralized and comprehensive data collection, organization, and analysis capabilities. Like so many other business processes, managing net working capital is much easier with help from digital transformation tools such as artificial intelligence, advanced data analytics, and robotic process automation. How to capture early payment discounts and avoid late payment penalties. Other receivables, such as income tax refunds, cash advances to employees and insurance claims. Accounts receivable, minus any allowances for accounts that are unlikely to be paid. Cost Of SalesThe costs directly attributable to the production of the goods that are sold in the firm or organization are referred to as the cost of sales.

Phản hồi